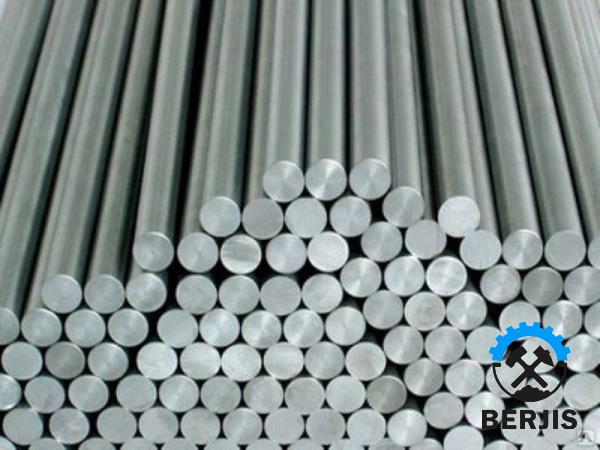

LME (London Metal Exchange) Steel Billet is an essential component of the steel industry. As a vital raw material used for various applications, it plays a pivotal role in the global metal markets. In this article, we will delve into the world of LME Steel Billet, discussing its characteristics, trading mechanism, and market trends. What is LME Steel Billet? LME Steel Billet refers to a semi-finished steel product in the form of a rectangular solid. It is produced through the continuous casting of molten steel and is then further processed into various steel products such as bars, rods, and wires. The LME Steel Billet provides a standardized specification for uniform quality and enhances price transparency across the industry. Characteristics and Specifications: LME Steel Billet has specific characteristics and specifications that facilitate its trading and usage: 1. Size and Weight: The standard LME Steel Billet size is 150mm x 150mm x 12m.

.

The weight of an individual billet is approximately 2 tons, making it convenient for transport and handling. 2. Chemical Composition: The chemical composition of LME Steel Billet may vary according to the specific requirements of different end-use applications. However, it generally contains iron as the main component along with carbon, manganese, silicon, and traces of other elements. 3. Quality Standards: LME Steel Billet adheres to international quality standards to ensure consistent and reliable performance. It undergoes rigorous testing for chemical composition, mechanical properties, and dimensional accuracy. Trading Mechanism: LME Steel Billet trading follows a transparent and efficient mechanism established by the London Metal Exchange.

The weight of an individual billet is approximately 2 tons, making it convenient for transport and handling. 2. Chemical Composition: The chemical composition of LME Steel Billet may vary according to the specific requirements of different end-use applications. However, it generally contains iron as the main component along with carbon, manganese, silicon, and traces of other elements. 3. Quality Standards: LME Steel Billet adheres to international quality standards to ensure consistent and reliable performance. It undergoes rigorous testing for chemical composition, mechanical properties, and dimensional accuracy. Trading Mechanism: LME Steel Billet trading follows a transparent and efficient mechanism established by the London Metal Exchange.

..

Here are a few key aspects of the trading process: 1. Exchange Platform: LME provides a centralized trading platform for buyers and sellers to engage in bilateral transactions. It ensures market liquidity and fair price discovery for LME Steel Billet. 2. Price Quotation: LME Steel Billet prices are quoted in US dollars per metric ton. The prices are determined based on supply and demand dynamics, industry trends, and global economic factors. 3. Hedging and Risk Management: LME offers hedging tools such as futures and options contracts to mitigate price risk. Market participants, including steel manufacturers, traders, and end-users, utilize these instruments to manage price volatility and protect their positions. Market Insights: Understanding the market trends and factors influencing LME Steel Billet prices is crucial for industry players. Here are a few factors to consider: 1. Global Demand and Supply: The demand for LME Steel Billet is driven by the construction, automotive, and manufacturing sectors. Industrial development and infrastructure projects in emerging economies significantly influence the demand-supply dynamics.

Here are a few key aspects of the trading process: 1. Exchange Platform: LME provides a centralized trading platform for buyers and sellers to engage in bilateral transactions. It ensures market liquidity and fair price discovery for LME Steel Billet. 2. Price Quotation: LME Steel Billet prices are quoted in US dollars per metric ton. The prices are determined based on supply and demand dynamics, industry trends, and global economic factors. 3. Hedging and Risk Management: LME offers hedging tools such as futures and options contracts to mitigate price risk. Market participants, including steel manufacturers, traders, and end-users, utilize these instruments to manage price volatility and protect their positions. Market Insights: Understanding the market trends and factors influencing LME Steel Billet prices is crucial for industry players. Here are a few factors to consider: 1. Global Demand and Supply: The demand for LME Steel Billet is driven by the construction, automotive, and manufacturing sectors. Industrial development and infrastructure projects in emerging economies significantly influence the demand-supply dynamics.

…

2. Raw Material Prices: The cost of iron ore, coal, and other inputs in the steel production process impact LME Steel Billet prices. Fluctuations in raw material prices can have a cascading effect on the billet market. 3. International Trade and Tariffs: Trade policies, tariffs, and geopolitical factors can create uncertainties and disruptions in the LME Steel Billet market. Changes in import/export regulations and trade disputes between major economies can influence prices. Conclusion: LME Steel Billet holds immense importance as a key raw material in the steel industry. Understanding its characteristics, trading mechanism, and market trends is essential for industry participants to make informed decisions. By staying abreast of global market dynamics, stakeholders can effectively manage risk, ensure supply chain stability, and maximize opportunities in the ever-evolving steel sector.

2. Raw Material Prices: The cost of iron ore, coal, and other inputs in the steel production process impact LME Steel Billet prices. Fluctuations in raw material prices can have a cascading effect on the billet market. 3. International Trade and Tariffs: Trade policies, tariffs, and geopolitical factors can create uncertainties and disruptions in the LME Steel Billet market. Changes in import/export regulations and trade disputes between major economies can influence prices. Conclusion: LME Steel Billet holds immense importance as a key raw material in the steel industry. Understanding its characteristics, trading mechanism, and market trends is essential for industry participants to make informed decisions. By staying abreast of global market dynamics, stakeholders can effectively manage risk, ensure supply chain stability, and maximize opportunities in the ever-evolving steel sector.